Made Easy.

From our families to yours, we're honored to be a part of your next step!

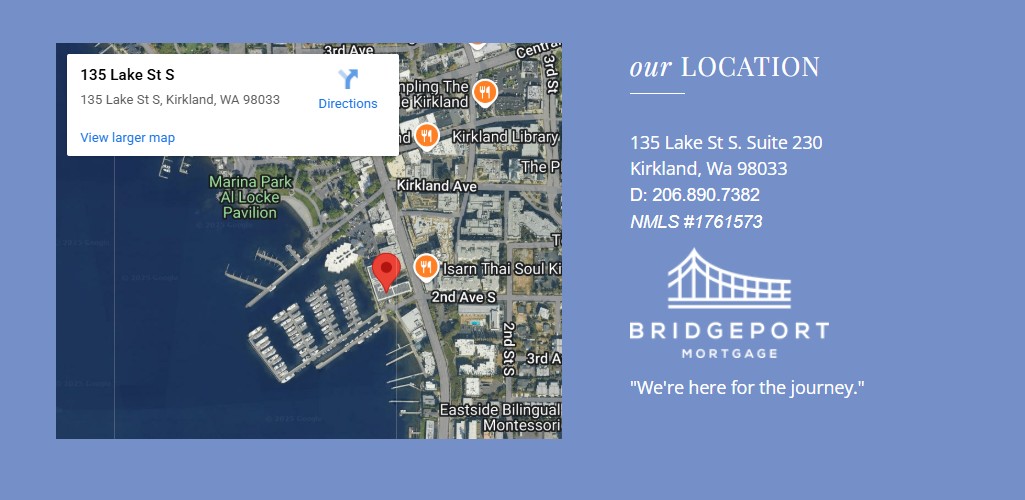

©Copyright Adcom Group Inc. dba Bridgeport Mortgage. All Rights Reserved. NMLS #1761573. The content provided within this website is presented for information purposes only. This is not a commitment to lend or extend credit. Information and/or dates are subject to change without notice. All loans are subject to credit approval. Other restrictions may apply. 135 Lake St S. Suite 230, Kirkland Wa 98033. 833-395-5626

We do not share data with third parties for marketing/promotional purposes. All the above categories exclude text messaging originator opt-in data and consent; this information will not be shared with any third parties. Text messaging opt-in data is not being shared with third parties. https://adcomgrp.com/privacy.php

NMLS Consumer Access Contains licensing/registration information on mortgage companies, branches, and loan originator professionals licensed by state regulatory agencies participating in the Nationwide Mortgage Licensing